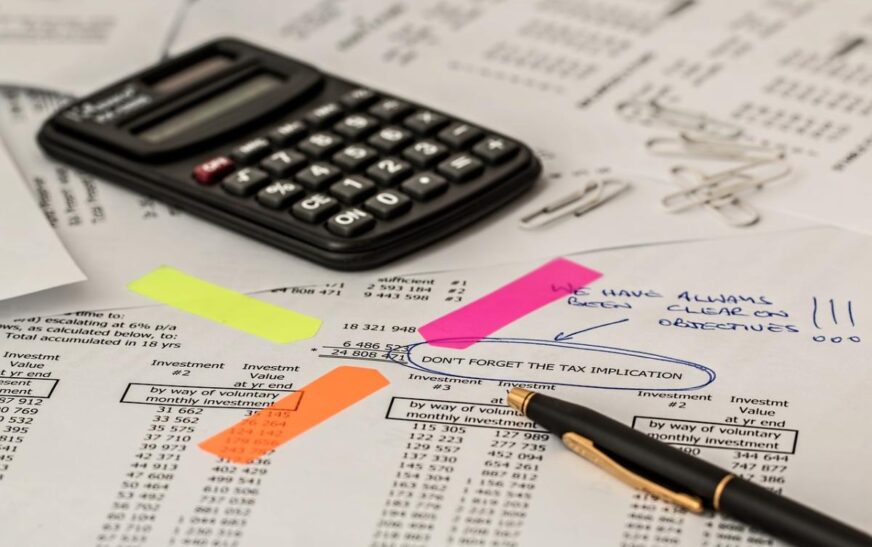

A reliable savings plan symbolises a well-managed financial portfolio. It ensures future financial security and helps you easily reach several financial targets.

Since the market is loaded with multiple varieties of savings plans, it might feel a bit overwhelming to decide which one to select. However, we have elucidated certain significant factors that you need to consider to ensure a smooth selection.

Factors to consider while selecting the best long-term savings plan

The essential factors that you need to consider while making your long-term savings plan selection include the following:

- Financial goals:

Assessing your true financial goals is very crucial to deciding how much savings you require. The targets can be varied like funding your children’s education, buying a house, foreign trips, marriage, etc. You might also wish to secure the financial future of your beloved family despite your absence. All these targets must be crystal clear in your mind to ensure a smooth planning process. - Risk and reward:

Your savings plans must include reliable investment options, combining both rewards and risks. Before investing, you must be careful about your risk tolerance capacity. Ensure to maintain a proper balance between your risks and rewards. - Liquidity:

Financial emergencies might appear at any time for various reasons. It is best to stay prepared for such contingencies beforehand, ensuring a balanced financial portfolio. Ideally, a long-term savings plan offers enough liquidity to handle such emergencies. Your chosen investment option must consider both your current and future liquidity needs. - Tax efficiency:

Tax benefits associated with any investment option are critical. Several options like life insurance, health insurance, etc., allow tax benefits. If you invest in these sorts of plans, you can enjoy both security and tax benefits. If you pay a 30 lakh term insurance premium, you will receive tax deductions up to INR 1.5 lakhs/annum u/s 80C of the IT Act. - Investment diversity:

An ideal long-term savings plan allows you to diversify all your funds across several products. Such balanced diversification reduces the risks associated with investments and ensures better wealth building in the long run. However, critical evaluation is essential so that it aligns with your financial goals to ensure the desired outcome. - Performance:

You must regularly monitor the performance of your investments. This will help you to review the situation so that you can make the necessary alterations required and applicable to fulfil your targets. - Eligibility:

Ensure that all the relevant eligibility criteria are fulfilled while investing. Every long-term investment is associated with a premium payable amount maintaining a specific schedule. This must not burden your budget and must align with your goals. - Terms and conditions:

Before purchasing any investment plan, you must be well aware of all the associated terms and conditions. Clarify all your doubts and ambiguities from authentic sources like the company authorities or professional advisors before finalising. - Investment tenure:

Your chosen investment options must align with your financial targets, which will be timed differently. Ideally, a reliable savings plan will smoothly handle both short-term and long-term targets. The duration of investment is also very crucial to fulfil the objectives timely.

Features of savings plans

The nature of the concerned savings plan determines its unique features. A rightly selected savings plan will allow you to withdraw a part of your investment for short-term goals and maintain the rest for the long term. A fixed tenure savings plan may range between 5 and 10 years or 25 and 35 years, depending on the type of plan chosen,

Therefore, your savings plan must allow comprehensive coverage with financial security and alternatives. However, consider all the benefits and drawbacks of the plan before finalising it.

- Flexibility in a Savings Plan

While investing in a long-term savings plan, it is crucial to consider the plan’s flexibility. This means you can withdraw funds during emergencies. Such flexibility reduces the overall risks.

However, in the case of any tax-saving instrument, it is better to hold it for long uninterruptedly to ensure a better outcome.

- Cost

Usually, savings plans are cheap with nominal handling costs. If you snip the entire capital as an expense, the accumulated capital will naturally reduce in future. So, making the right choice and understanding all the associated costs is crucial. Moreover, these prices are so negligible that they hardly make any impact in the long run, making it an ideal avenue for wealth creation.

Conclusion

A well-planned and well-executed savings plan aids you in more ways than one. It boosts the overall financial planning and ensures you maintain a balanced, reliable and flexible portfolio, allowing tax benefits when applicable. You must ensure to make a critical assessment of your targets and requirements before you make your final choice.

Also Read: A Comprehensive Introduction to Digital Marketing